Published on May 2, 2016

In Q1 2016 people have massively speculated in all sorts of ways about the state of venture capital in Europe. As a logical result of the recent slowdown in tech funding and slowdown in amount of funds raised in the US. But, what exactly is the state of Venture Capital? Is it funds raised, amounts deployed, number of tech sector IPO’s or one of many other numbers related to the industry? The one people tend to focus on most is however the funds invested. But, can we base our opinions on the data providers? Let us take a brief look at what we’ve been seeing to reflect on how to form an opinion on the state of Venture Capital. Credits to Yannick Roux (@yanroux) for the graphs.

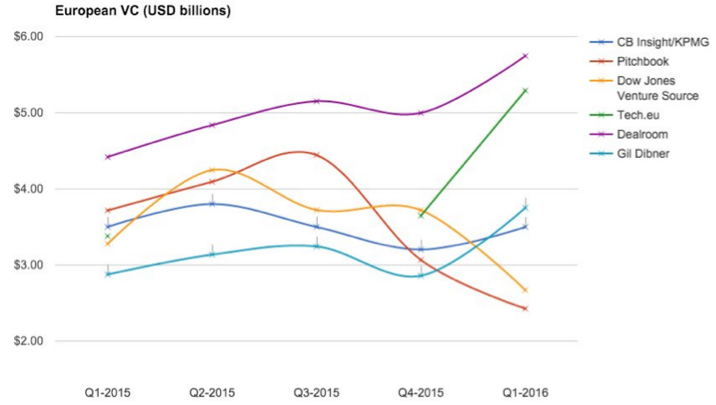

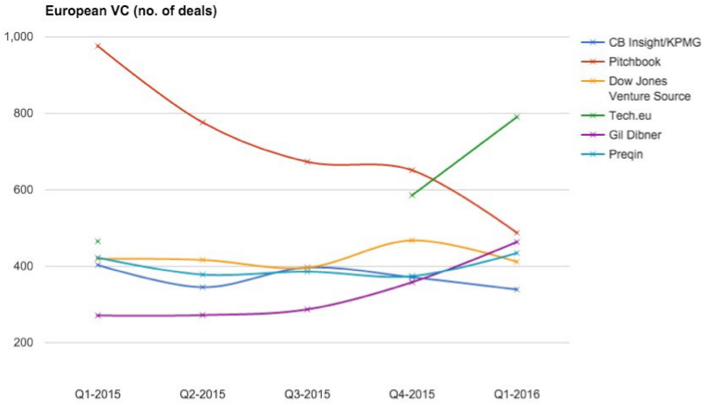

Looking at the graphs I am very interested in what Pitchbook and Dow Jones Venture Source are trying to say here. They suggest the amount of deals are down and the amounts invested is down as opposed to the last quarter. While, the other data providers suggest investments are actually up. Could it be a result of the way they collect the data or how they process it? Tech.eu, Dealroom.co, Gil Dibner and CBinsights have a data first approach whereas as far I’m concerned, Pitchbook, Dow Jones and Preqin have a manual first approach. I have no opinion on the accuracy of either approach, but do like to point out that their differences in the above graphs are illustrating.

The real issue here is not the way data providers do their collection, but how people use the data to ‘call’ a certain point in time, often only based on one of the data sources. During the research I particularly liked the Pitchbook Venture Industry Report Q1 front cover which suggests we use the Matterhorn as leading indicator of where the industry is heading.

And, this is only one of the many reports that is ‘calling’ something.

The thing is, we are not seeing any disaster happening at the moment, nor are there indicators that the venture industry in Europe blew itself up or that we are heading for a crisis based on underlying issues such as overvalued assets with long lasting debt. What we are seeing is a cool down period after a very steep growth period based on real underlying principles.

Look at data and form an opinion based on a broad set of inputs to judge or ‘call’ something! As at the moment all VCs I talk to, talk about happy times and great returns. I would love to hear what others think, please reply in the comments.