Published on June 30, 2016

The financial side of a VC investment has many different aspects. The basics however go by a pretty clear structure. Being able to get the basics right, makes the investment case story easy and understandable. Use this proposed structure to test yourself on your investment case story and hopefully increase your speed of fundraising!

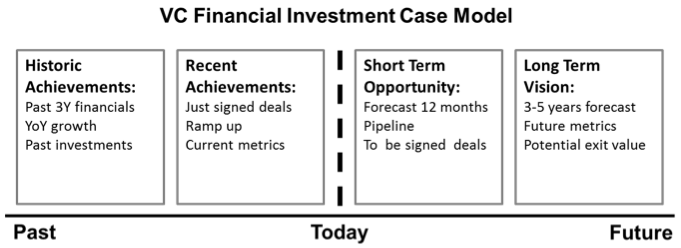

The let’s start with a nice model to visualize the structure. It consist of only four elements.

Historic Achievements

VCs want to know where you came from and how the company evolved over the past years. This is the achievement until now and is something a company should be proud of. It also makes sense to understand what the costs were until now, or in other words, what the investments were to understand how efficient the company has been.

Recent Achievements

Recent achievements are very important to get the appetite of VCs. Pick your cherries here, information overload could lead to disbelief. The main point here is to show that certain key milestones have been met, such as signing of a key customer or getting the CAC/LTV ratio right.

Short Term Opportunity

During the first months of a VC investment it is vital to show progress and prove your company was the right choice to invest in. By being clear about the pipeline and to be signed deals in the next 12 months, the VC can get comfortable with the fact that the company will progress right after the investment.

Long Term Vision

According to some the long term finance is the most important part of the business, as it is where the actual return is made. The actual forecast is a must, but certainly not the most important part of the investment case. Key here is to get a broad understanding of why the company is an interesting investment opportunity. Are the gross margins going to increase enormously? Are the network effects possibly of the charts? Is the company able to scale faster than others? The answers lead to certain values of the business, which give insight in how much return in what case can be made.

Use this structure and model to create your investment case story. Hopefully it proves to be helpful and results in awesome investments!